cash settled warrants

In this MS will just pay the difference to BNP of 2 and the deal gets settled. To be determined Issue Size 13 million Warrants Type European Style Cash Settled Put Warrants out of the money1 Launch Date 09 June 2022 Underlying Shares DBS Group Holdings Ltd RIC.

Cash Settlement Price 20500 20200 900 x 050 MYR 01667 per warrant If you are holding 100000 units of HSI-C14 after the warrants last trading day on 25th March Friday you will receive MYR 16670 which is calculated as per below.

. School Kaplan Business School. Cash settlement warrants Form of settlement in which the issuer of the warrant pays a cash sum to the warrant holder instead of delivering the underlying instrument. 3690HK Class B IssueInitial Settlement Date 28 June 2022 Underlying Price1 and Source HKD 194000 ReutersBloomberg Expected Listing Date 29 June 2022.

Number of Warrants being issued. Course Title FIN MISC. Derivative Warrants Hang Seng Index 2020194 2790 014 HSCEI 690218 2249 033 Hang Seng TECH Index 441586 3474 079 MSCI China A 50 Connect Index 232281 2418 105 HSI Volatility Index 2399 -134 -529 CSI 300 Index 415691 5537 135 CES China120 Index 581320 2520 043 USDCNH Spot 67665.

A cash settlement is a settlement method used in certain futures and options contracts where upon expiration or exercise the seller of the financial instrument does not deliver the actual. With cash-settled futures there is no transfer of LME warrants or physical metal. DBSMSI IssueInitial Settlement Date 14 June 2022 Underlying Price1 and Source SGD 30400 ReutersBloomberg Expected Listing Date 15 June 2022.

Cash settled warrants are settled by a cash payment. Exercise Price per Warrant which may be subject to adjustment in accordance with Condition 15B in the case of Share Warrants. Like in this case MS will pay 10002 2000 to BNP and the trade is cash-settled.

Although warrants are often settled by the issuance of equity shares the warrants themselves may not necessarily be classified as an equity instrument. Shall have the meaning assigned to it in Section 301f. Warrantholders will not be required to deliver an exercise notice.

More CASH SETTLED WARRANT Resources Microsoft Word - 1stHalfResults99-corretttodoc 5 176 1 Extraordinary item in 1998 principally related to non-recurring expenses for the cash settled warrant rights granted to the credit. The positive difference between the current price of the share and the warrants exercise price. Options work in a similar manner with cash settlement as we had a look at the example above of the put option.

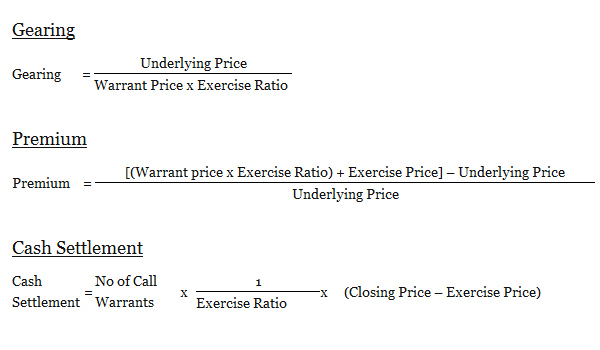

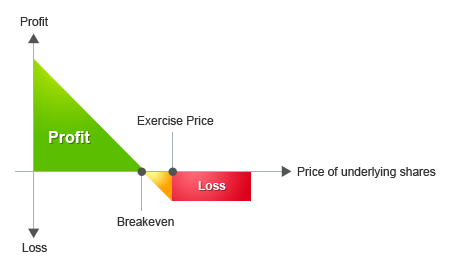

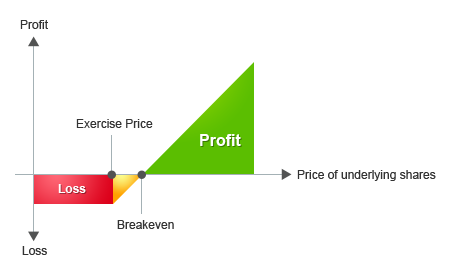

The issuer can also issue warrants that are cash settled based on the future value of the shares. Cash settlement is an arrangement under which the seller in a contract chooses to transfer the net cash position instead of delivering the underlying assets whereas physical settlement can be defined as a method under which the seller opts to go for the actual delivery of an underlying asset and that too on a pre-determined date and at the same. Cash Settlement Amount for Call Warrant Closing Price of Underlying Shares Exercise Price Exercise Ratio Cash Settlement Amount for Put Warrant Exercise Price Closing Price of Underlying Shares Exercise Ratio.

The actual delivery is of the cash where the. The Warrants are cash-settled warrants which entitle a Warrantholder to be paid a cash settlement amount if positive the Cash Settlement Amount in accordance with the terms and conditions of the Warrants. In the case of cash-settled warrant if the current price of the underlying share is higher than the warrants exercise price and the warrant is exercised before the maturity period the holder will be entitled to the cash amount ie.

Cash settlement involves the purchaser or the contract holder to pay the net cash amount on the settlement date and execute the commodity settlement. Define Cash Settled Warrants. 70000000 Warrants Total number of Warrants in issue.

100000 units of HSI-C14 x MYR 01667 per warrant MYR 16670. The warrant holder shall receive an amount of cash if greater than zero payable in RM calculated as follows. Issue price per Warrant.

Under IAS 32 equity classification applies to instruments where a fixed amount of cash or liability denominated in the issuers functional currency is exchanged for a fixed number of. 01 July 2021. This post contains affiliate links.

Also they are cash-settled and the warrant holder has to pay the cash to the company to receive the shares in lieu of the warrants. USD 00160 Re-offer price per Warrant. This often creates a synthetic bond.

Sometimes the company can issue shares at a very large premium sometimes up to 50 percent to compensate the warrant holders. Glossary Cash settlement warrants Form of settlement in which the issuer of the warrant pays a cash sum to the warrant holder instead of delivering the underlying instrument. The net cash amount is the difference between the spot price SP and the futures price FP of the underlying s.

Pages 46 This preview shows page 11 -. To be determined Issue Size 22 million Warrants Type European Style Cash Settled Put Warrants out of the money1 Launch Date 23 June 2022 Underlying Shares Meituan RIC. By 930 AM New York City time on the Exercise Settlement Date the Company shall make payment of the Cash Settlement Amount in immediately available funds to an account the Payment Account designated by the Warrant Agent or if applicable the relevant Paying Agent.

If the underlying instrument cannot be physically delivered to the warrant holder eg in the case of index warrants the contract is settled in cash. Cash-settled futures require the transfer of an amount of cash determined by the difference between the original fixed price of the contract and the floating final settlement price determined by the published reference price from the PRA. If the underlying instrument cannot be physically delivered to the warrant holder eg in the case of index warrants the contract is settled in cash.

Article continues below advertisement Usually SPAC IPOs come.

Equinox Share Purchase Warrants What A Difference An Issuing Motivation And A Currency Makes Ir Global

Warrant Gearing Premium Cash Settlement I3investor

Equinox Share Purchase Warrants What A Difference An Issuing Motivation And A Currency Makes Ir Global

Warrant Handbook Strategies Nagawarrants

Warrant Quick Guide Ambank Group Malaysia

Equinox Share Purchase Warrants What A Difference An Issuing Motivation And A Currency Makes Ir Global

Equinox Share Purchase Warrants What A Difference An Issuing Motivation And A Currency Makes Ir Global

Warrant Quick Guide Ambank Group Malaysia

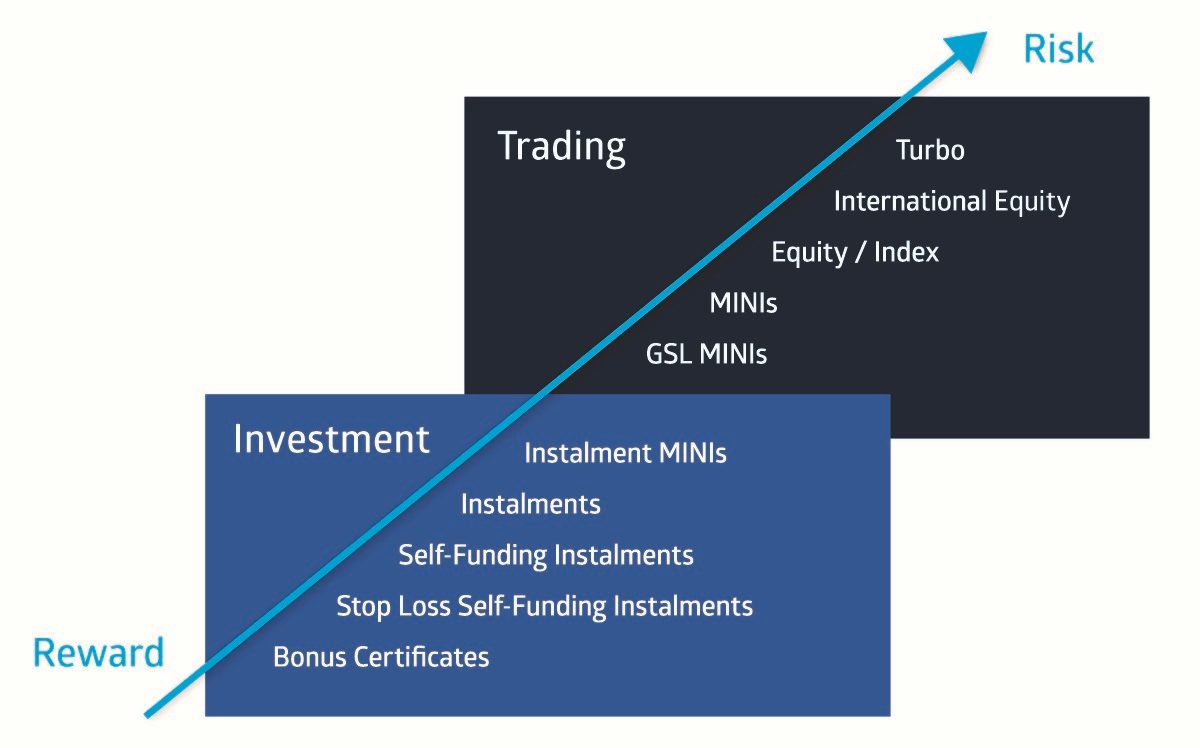

Cfds Versus Warrants And Turbos Contracts For Difference Com

Total Return Swap Definition Cash Settled Equity Swap Explained

Equinox Share Purchase Warrants What A Difference An Issuing Motivation And A Currency Makes Ir Global

Warrant Handbook Warrant Expiry Nagawarrants

0 Response to "cash settled warrants"

Post a Comment